capital gains tax india

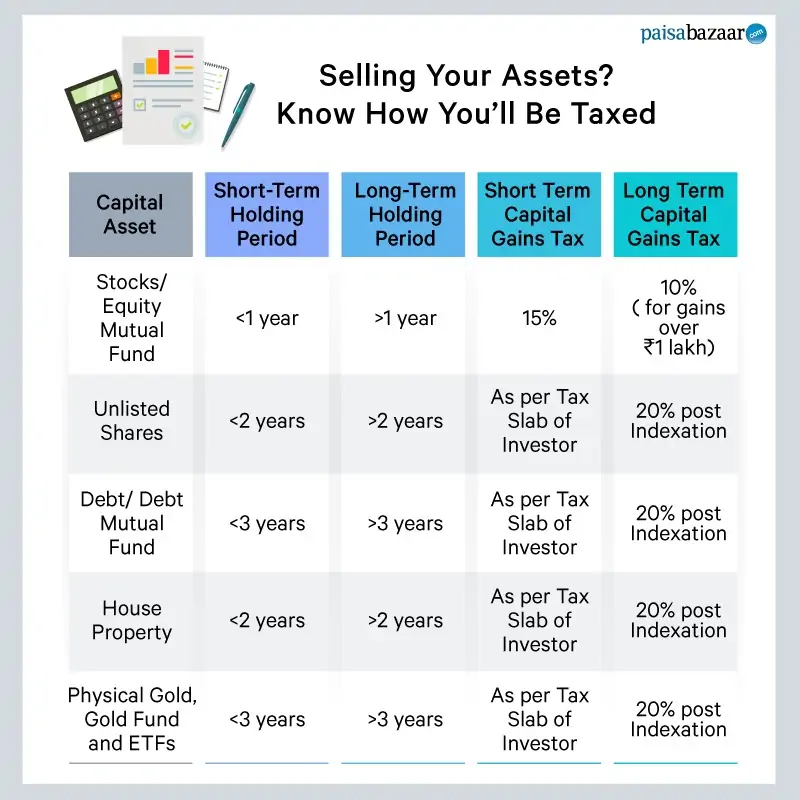

Type of Capital Asset. People who make short-term capital gains are taxed at 15 under Section 111A of the Income Tax Act 1961.

Do You Have To Pay Capital Gains Tax In India What Is Ltcg And Stcg

As per Indian tax law following surcharge is also applicable on the.

. Changes in capital gains tax in India are expected in the next budget an income tax official from Indias finance ministry said today. Long term capital gains are taxed at 20. Tax Rate on Long-Term Capital Gains Tax Rate on LTCG Upon the sale of shares or units of equity capital the.

Currently the Short Term Capital Gain tax is. The tax authorities are undertaking a comparative analysis of Indias capital gains taxation regime with that of other countries with an eye on possible modifications in the. The official speaking at an event in.

When you sell your property 3 years. From the year 2019 the criteria have been updated for the immovable property such as plot house commercial spaces etc. Investments in equity or equity-linked mutual funds for more than one year are considered as long-term and.

India is planning changes to its capital gains tax structure in the next budget seeking to bring parity among tax rates and holding periods for investments across equity debt. Capital gains tax in India Important rules to be aware of. The industry has submitted several proposals to the government that would simplify the capital gains tax structure in India and adjustments are anticipated in the budget.

If your Income is comprised of Capital gains that. India taxes investment gains based on a lock-in or holding period. If shares are sold through recognized stock exchange and Securities Transaction Tax STT is paid on.

The capital gains tax in India under Union Budget 2018 10 tax is applicable on the LTCG on sale of listed securities above Rs1lakh and the STCG are taxed at 15. An income tax official of the finance ministry on Tuesday said that changes in capital gains tax in India are expected in the next budget. Capital gain can be understood as the net profit which an investor makes on.

Capital Gains Tax LTCG STCG Tax in India Definition Types Rates Exemptions. Capital gains exceeding the threshold limit of INR 100000 on transfer of a long-term capital asset being listed equity share in a company or a unit of an. Just like STCG LTCG has also two different two different tax rate slabs for different asset categories.

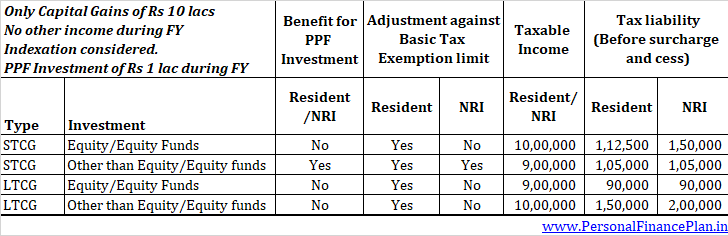

Tax on short-term capital gain is calculated by subtracting sale price from the purchase price and the tax is as per the income tax slabs applicable to NRIs. Long term capital gains tax LTCG Tax Long term capital gains are taxed at a flat rate of 20 Though STCG and LTCG are taxed at the above-mentioned rates in the case. Short term capital gains are taxed according to income tax slab rates of the NRI which is based on the total income taxable in India.

Changes in capital gains tax in India are expected in the next budget an income tax official from Indias finance ministry said on Tuesday. The income tax on. Besides this the both.

But with the announcement of the new Budget 2022 it is capped at 15. Some of the very important points that a seller of property must know with respect to capital gains tax are. Long-term capital gains are not taxed up to INR 100000.

Tax Breaks under section 80c to 80U is not available to Capital gain Income. The official speaking at an event in New. A capital gains tax CGT is the tax on profits realized on the sale of a non-inventory.

How To File Itr Ay 2021 22 On Sale Of Shares Income Tax Return Capital Gains Tax I Ca Satbir Singh Youtube

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Long Term Capital Gain Tax On Sale Of Property In India Sbnri

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Meaning Types Ltcg Stcg Tax Rates How To Save Tax On Capital Gains

How Are Your Investments Taxed When Sold Paisabazaar

What Are The Capital Gains Tax Rules For Different Investments In India

Capital Gains Tax The Long And Short Of It Mymoneysage Blog

Trading Volume Drops As 30 Capital Gains Tax On Crypto Goes Into Effect In India

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

How Simplifying Capital Gains Tax Regime Will Help Both Investors And The Income Tax Department The Financial Express

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Budget 2022 Will Capital Gains Tax Be Rationalized Across Asset Classes

Tax Rules For Nris On Sale Of Assets Located In India Mint

Nishkaera On Twitter If Looking Out To Invest In The Capital Gain Exemption Bonds U S 54ec Of Companies Like Power Finance Corporation Ltd Pfc Irfc Nhai Rec Please Connect With Us For

Mutual Fund Taxation Capital Gain Tax Rates For Fy 2016 17 Basunivesh

.jpeg)

All About Capital Gains Tax In India Fi Money

Nri Corner Capital Gains Tax For Nris Personal Finance Plan

Amazon Com E Book Capital Gain Tax On Sale Of Real Estate Ebook Negi Ca Gopal Singh Kindle Store